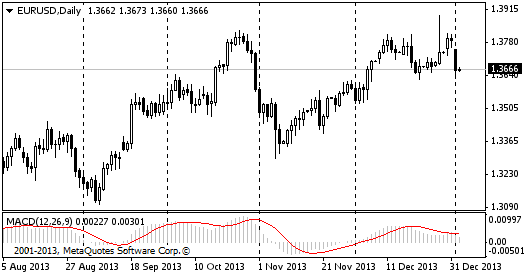

This indicator is one of the most popular technical indicators out there, and it is one of the main ones used in FXLORDS’ Forex Trading Signals. MACD measures the correlation between two moving average curves. It is the difference between the arithmetic exponential mean of 12 and 26 periods. In order to clearly show buy and sell signals, the 9 periods moving (so-called signal line) is plotted on the MACD chart.

This indicator proves effectiveness in high volatility or fast moving markets.

There are three common ways to use the indicator; Crossovers, Overbought/ Oversold Conditions and Divergence.

Crossovers The basic rule of trading using this indicator is to sell when the moving average convergence/ divergence (MACD) penetrates line signal line from top to bottom. Similarly, a buy signal is generated when the moving average convergence / divergence line breaks through the signal line from the bottom to the top. It is also common to buy and sell when the MACD line crosses the zero level.

Overbought/ Oversold Conditions The MACD chart is also useful when identifying overbought and oversold conditions. When the Short Moving Average pulls away dramatically from the long term moving average (i.e., when the MACD value rises), it is likely that prices have overly saturated and will soon return to more realistic levels.

Divergence it is an indication that the current trend is near an end, and that is when the price deviates from the value of the Moving Average Convergence / Divergence (MACD) curve. Upward (Positive) Deviation curve occurs when the Moving Average Convergence / Divergence (MACD) reaches new highs while prices are unable to succeed in reaching a new level, and vice versa is true, Downward (Negative) Deviation occurs when the Moving Average Convergence / Divergence (MACD) reaches new lows while prices are unable to succeed in reaching a new low. These deviations are of great importance when they occur in Overbought/ Oversold Conditions.

FXLORDS Increase Your Profits

FXLORDS Increase Your Profits